How much money can I borrow and how do the re-payments work ?

urLoan™ was developed from the ground up to give the Canadian consumer an alternative to unreasonable Payday Lenders and commercial banks who often require you to own your home to get financing. urLoan™ is distinct in many ways, but most importantly because we only provide you a term or debt consolidation loan that is financially healthy for you to pay back.

We work with you from the onset of obtaining your term loan to ensure you have planned to manage its repayment effectively.

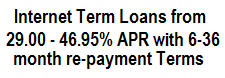

urLoan™ provides flexible term loans and debt consolidation loans from $1,000-$15,000 with repayment terms ranging from 6 to 36 months and your loan can be approved within 24-48 hours. Whether you are in a situation where you have little or no credit history or you wish to consolidate your existing debts, urLoan™ is YOUR LOAN. Call us today and find out how urLoan™ can help you.